Blockchain technology has revolutionized various industries by providing decentralized, immutable, and transparent systems.

However, blockchains are inherently isolated from the outside world, meaning they cannot directly access real-world data, such as stock prices, weather conditions, or sports results.

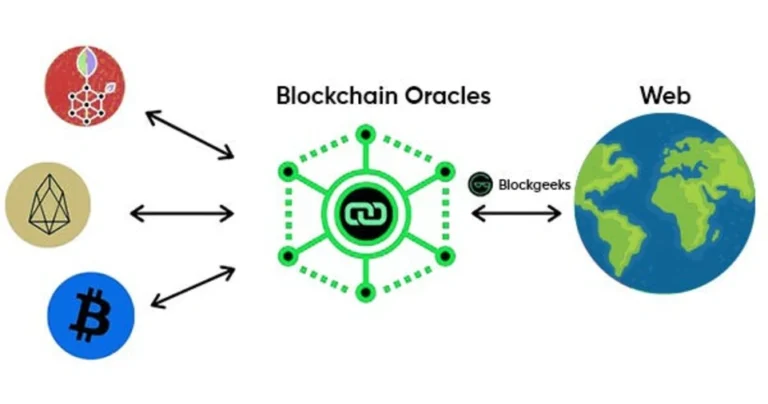

This is where oracles come into play. Oracles act as intermediaries that fetch external data and deliver it to blockchain smart contracts, enabling them to interact with off-chain information.

Oracles are essential in decentralized finance (DeFi), gaming, insurance, supply chain management, and other blockchain applications.

Without oracles, smart contracts would be limited to on-chain data, drastically reducing their real-world utility.

Given their importance, it is crucial to understand how oracles work, the different types available, how to integrate them into smart contracts, and the best security practices for their implementation.

This article provides a comprehensive guide on how to use oracles in blockchain smart contracts, covering everything from choosing the right oracle to deploying a functional smart contract.

Additionally, we will discuss potential future developments in oracle technology and their implications for blockchain applications.

Understanding Blockchain Oracles

What Are Blockchain Oracles?

A blockchain oracle is an external service that supplies smart contracts with off-chain data.

Since blockchain networks operate in a closed environment and cannot fetch external information independently, oracles bridge this gap by fetching, verifying, and transmitting real-world data to smart contracts.

This data can include financial market prices, weather updates, event outcomes, and even IoT sensor data.

Oracles act as trusted third-party data providers, ensuring that smart contracts have reliable and timely access to external information.

These data providers play a crucial role in various industries, enabling smart contracts to automate transactions and execute agreements based on verified data.

Without oracles, blockchain technology would remain confined to applications that solely rely on on-chain data, limiting its overall impact.

Why Are Oracles Important?

Smart contracts are designed to execute automatically when predefined conditions are met.

However, if the required data for execution is not available on the blockchain, the smart contract becomes ineffective.

Oracles solve this problem by providing verified data inputs, allowing smart contracts to function dynamically based on real-world conditions.

This expands the use cases of blockchain technology beyond simple token transfers to applications such as decentralized finance (DeFi), insurance automation, and prediction markets.

Oracles enable blockchain networks to integrate real-world information seamlessly, facilitating the creation of sophisticated decentralized applications (dApps).

For example, DeFi platforms rely on oracles to fetch real-time asset prices, while supply chain networks use oracles to track shipments and verify product authenticity.

The ability to incorporate off-chain data significantly enhances the capabilities of blockchain ecosystems, making oracles indispensable for widespread adoption.

Types of Blockchain Oracles

Oracles can be categorized based on the source, direction of data flow, and their level of centralization.

Understanding these types is crucial when selecting an oracle for your smart contract.

Based on Data Source

Software Oracles

Software oracles retrieve data from digital sources such as APIs, online databases, and web services.

These oracles provide real-time data such as stock prices, exchange rates, and weather conditions.

They are commonly used in financial applications, sports betting, and market forecasting platforms.

Hardware Oracles

Hardware oracles obtain data from physical devices like IoT sensors, barcode scanners, and RFID chips.

They are used in applications like supply chain tracking and automated insurance claims.

By integrating physical-world data with blockchain networks, hardware oracles help verify conditions such as temperature, location, and humidity levels, ensuring compliance with contract terms.

Based on Data Flow

Inbound Oracles

Inbound oracles bring external data into the blockchain. For example, an inbound oracle can provide a smart contract with the latest Bitcoin price from an exchange.

This functionality is crucial for DeFi platforms, as accurate and up-to-date pricing data is necessary for lending, borrowing, and trading protocols.

Outbound Oracles

Outbound oracles send blockchain data to external systems.

They are useful in cases where an event on the blockchain needs to trigger an off-chain action, such as notifying a bank to process a payment or updating an insurance provider about a claim settlement.

This bidirectional communication expands blockchain’s ability to interact with existing IT infrastructure.

Based on Trust Model

Centralized Oracles

Centralized oracles are controlled by a single entity or organization. While they are efficient, they pose a single point of failure and are susceptible to manipulation.

Companies and individuals must trust the entity managing the oracle, which introduces risks related to data integrity and reliability.

Decentralized Oracles

Decentralized oracles aggregate data from multiple sources and use consensus mechanisms to verify accuracy.

Chainlink is a prime example of a decentralized oracle network, enhancing security and reducing the risk of a single point of failure.

Decentralized oracles help prevent fraudulent data inputs and ensure that smart contracts rely on reliable information.

ALSO READ: How to Optimize Gas Fees on Ethereum and Other Networks

Selecting the Right Blockchain Oracle Provider

Choosing the right oracle provider depends on various factors such as security, cost, and ease of integration.

Below are some of the most widely used blockchain oracle providers:

Chainlink

Chainlink is the most popular decentralized oracle network.

It aggregates data from multiple sources and uses a decentralized network of nodes to ensure accuracy and security.

It is commonly used for price feeds in DeFi applications and supports a variety of blockchain networks.

Band Protocol

Band Protocol is a cross-chain data oracle that operates on multiple blockchains, including Ethereum and Binance Smart Chain.

It provides fast and secure data access for smart contracts and enables developers to create customized oracle solutions.

API3

API3 is a first-party oracle network that allows API providers to run their own nodes, eliminating the need for intermediaries and reducing costs. It focuses on transparency and reliability, ensuring that data sources are verifiable and free from manipulation.

Provable (formerly Oraclize)

Provable uses cryptographic proofs to ensure data integrity.

It is widely used in trustless applications requiring verified real-world data, such as insurance claims and identity verification systems.

Integrating an Oracle in a Smart Contract

Step 1: Install Required Dependencies

To integrate an oracle into your smart contract, first, install the required dependencies.

If using Chainlink, install its contract library in your Solidity project:

npm install @chainlink/contracts

Step 2: Write the Smart Contract

Below is an example of a Solidity smart contract that fetches ETH/USD price data using Chainlink:

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.7;

import "@chainlink/contracts/src/v0.8/interfaces/AggregatorV3Interface.sol";

contract PriceOracle {

AggregatorV3Interface internal priceFeed;

constructor() {

// Chainlink ETH/USD price feed address on Ethereum mainnet

priceFeed = AggregatorV3Interface(0x5f4ec3df9cbd43714fe2740f5e3616155c5b8419);

}

function getLatestPrice() public view returns (int) {

(

,

int price,

,

,

) = priceFeed.latestRoundData();

return price / 1e8; // Adjusting decimals

}

}

Step 3: Deploy the Smart Contract

Compile and deploy the contract using Remix IDE or Hardhat.

Step 4: Interact with the Oracle

Once deployed, call the getLatestPrice() function to fetch the real-time ETH/USD price.

ALSO READ: How to Use Cross-Chain Bridges for Token Transfers

Conclusion

Oracles play a vital role in enabling blockchain smart contracts to interact with real-world data.

As blockchain adoption grows, the evolution of decentralized oracles will continue to enhance the reliability and versatility of smart contracts across industries.

The future of oracles lies in improved security models, increased decentralization, and seamless integration with emerging blockchain platforms.