Blockchain forks are significant events that can impact investors, developers, and users in the cryptocurrency space.

Whether you are holding crypto assets or actively participating in blockchain development, understanding how to prepare for a fork can help you make informed decisions and protect your assets.

In this guide, we will explain what a blockchain fork is, why it happens, and how to effectively prepare for one.

We’ll also explore the implications of forks on users, miners, developers, and the broader blockchain community.

Additionally, we will cover post-fork scenarios and how to manage your assets after a fork occurs.

By the end, you’ll have a clear strategy to navigate upcoming forks with confidence and avoid potential pitfalls.

What is a Blockchain Fork?

A blockchain fork occurs when a blockchain network splits into two separate chains due to changes in its protocol. Forks can be categorized into two main types:

Soft Fork

A soft fork is a backward-compatible upgrade that does not split the chain. Nodes that do not upgrade can still participate in the network, but they may experience limitations in functionality. Soft forks typically require a majority consensus to enforce new rules and improve network efficiency.

Example: Segregated Witness (SegWit) upgrade in Bitcoin.

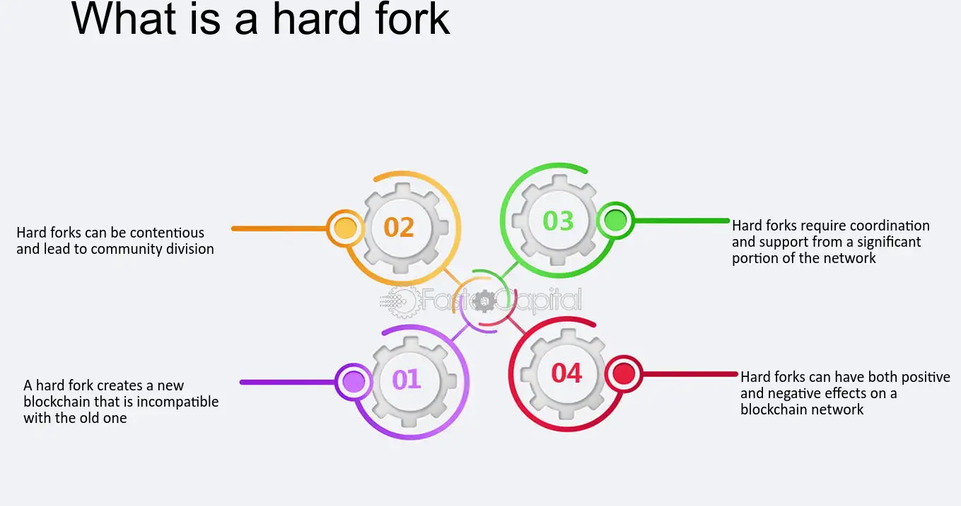

Hard Fork

A hard fork is a non-backward-compatible upgrade that results in a permanent split. It creates a new chain that operates independently of the original. Users holding coins before the fork may receive an equivalent amount on the new chain.

Example: Bitcoin Cash (BCH) was created from a Bitcoin (BTC) hard fork in 2017.

| Fork Type | Compatibility | Chain Split? | Example |

|---|---|---|---|

| Soft Fork | Backward-compatible | No | SegWit (Bitcoin) |

| Hard Fork | Non-backward-compatible | Yes | Bitcoin Cash |

ALSO READ:How to Integrate Blockchain into Traditional Financial Systems

Why Do Blockchain Forks Happen?

Forks can occur for various reasons, including:

- Protocol Upgrades: Developers propose changes to improve scalability, security, or efficiency.

- Community Disagreements: Conflicts in governance can lead to splits in the community.

- Security Fixes: Critical vulnerabilities may require immediate changes to the network.

- Network Upgrades: Implementing new features that are not compatible with previous versions.

- Economic Incentives: Some forks arise from financial motivations, such as creating an alternative token with perceived advantages.

- Disruptive Innovations: The introduction of novel technologies may lead to major changes in consensus mechanisms or smart contract capabilities.

How to Prepare for a Blockchain Fork

Stay Informed

The first step in preparing for a fork is to stay updated on news and announcements.

- Follow official blockchain project websites and their social media channels.

- Join Reddit forums, Telegram groups, and Twitter discussions for real-time insights.

- Check developer updates on GitHub to understand proposed changes.

- Read whitepapers or official announcements to gauge the fork’s purpose and potential impact.

- Set up Google Alerts for upcoming blockchain forks to get notifications as soon as new developments arise.

Secure Your Private Keys

Before a fork, ensure that you have full control over your crypto assets.

- Move funds from exchanges to private wallets where you control the private keys.

- Consider using hardware wallets like Ledger or Trezor for enhanced security.

- Ensure your wallet supports both chains if you intend to claim forked tokens.

- Test your wallet backups to ensure they work correctly before the fork happens.

Understand Exchange Policies

Different exchanges handle forks differently. Some may support the new chain, while others may not.

- Check if your exchange will credit users with forked coins.

- Be aware of any trading suspensions during the fork period.

- Understand whether exchanges will allow withdrawals of forked coins.

- Ensure you comply with any specific exchange requirements to be eligible for receiving forked tokens.

Backup Your Wallet

Backing up your wallet ensures you can recover your funds if something goes wrong.

- Use seed phrases or private keys for recovery.

- Store backups in a secure offline location.

- Consider multiple backups in different physical locations.

- Encrypt your backups for additional security.

Monitor Fork Dates and Block Heights

Blockchain forks occur at a specific block height (a numbered position in the blockchain).

- Set alerts on blockchain explorer websites like Blockchair or Etherscan.

- Avoid making transactions close to the fork date to prevent replay attacks.

- Consider pausing high-value transactions until the network stabilizes.

- Use multiple block explorers to verify accurate block height tracking.

Beware of Scams and Fake Forks

Fraudsters often take advantage of forks to scam users.

- Avoid sharing private keys or entering them into unknown websites.

- Only claim forked coins using official wallets or trusted platforms.

- Verify a fork’s legitimacy through official sources before making any moves.

- Be cautious of phishing scams pretending to be fork-related announcements.

What Happens After a Fork?

| Scenario | Outcome |

|---|---|

| Forked Chain Survives | Users may receive equivalent coins on the new chain. |

| Original Chain Dominates | The new chain may lose value and disappear. |

| Exchanges Support Both | Users can trade and utilize both chains. |

| One Chain Gains Majority Hash Power | The weaker chain may experience security risks. |

| Community Adoption Determines Value | Market dynamics decide which chain has greater use and value. |

| Temporary Chain Instability | Initial high volatility can affect asset values and transaction speeds. |

Case Studies of Notable Forks

Bitcoin Cash (BCH) Hard Fork (2017)

- Disagreement over Bitcoin’s scalability led to Bitcoin Cash.

- Bitcoin holders received BCH at a 1:1 ratio.

- The market eventually determined the value of both chains.

Ethereum and Ethereum Classic (2016)

- Ethereum forked due to the DAO hack.

- Ethereum Classic (ETC) continued with the original blockchain.

- Ethereum (ETH) became the dominant chain.

Ethereum 2.0 Upgrade (Upcoming)

- Transitioning from Proof of Work (PoW) to Proof of Stake (PoS).

- Major protocol change but not a contentious hard fork.

- Expected to improve scalability and energy efficiency.

Bitcoin SV (2018)

- Bitcoin Cash underwent another fork due to differences in block size.

- Led to Bitcoin SV (BSV), advocating for large block sizes and enterprise solutions.

- The chain with more adoption (BCH) retained a larger market share.

ALSO READ:How to Use Blockchain for Decentralized Identity Solutions

Conclusion

Blockchain forks can present both risks and opportunities. By staying informed, securing your private keys, and understanding exchange policies, you can navigate these events safely and maximize potential benefits. Preparing ahead of time ensures that you retain control over your assets and take advantage of new opportunities that forks may present.