Cryptocurrency mining is a fundamental process in the blockchain ecosystem, allowing decentralized networks to validate transactions and secure their operations.

Mining involves solving complex cryptographic puzzles using powerful computing hardware, in return for cryptocurrency rewards.

While Bitcoin mining has become highly competitive and requires specialized ASIC (Application-Specific Integrated Circuit) hardware, many alternative cryptocurrencies still allow individual miners to participate with GPUs (Graphics Processing Units) or even CPUs (Central Processing Units).

This guide provides an in-depth step-by-step process on how to start mining cryptocurrency.

Whether you are a beginner looking to mine your first coins or an experienced miner seeking optimization strategies, this guide covers everything from selecting the right cryptocurrency to setting up your mining rig, configuring mining software, and maximizing profitability.

Read on to learn how to mine cryptocurrency efficiently, securely, and profitably.

What is Cryptocurrency Mining?

How Does Cryptocurrency Mining Work?

Cryptocurrency mining is the process of verifying transactions on a blockchain network. It involves solving mathematical puzzles that require computational power.

Miners use specialized hardware to process transactions and add them to the blockchain ledger. In return, they receive rewards in the form of newly minted cryptocurrency.

Proof-of-Work (PoW) Mining Explained

Most mineable cryptocurrencies use the Proof-of-Work (PoW) consensus mechanism. PoW requires miners to compete in solving cryptographic puzzles.

The first miner to solve the puzzle and validate a block receives a reward. The more computational power a miner has, the higher their chances of earning rewards.

Step-by-Step Guide to Mine Cryptocurrency

Choosing the Right Cryptocurrency to Mine

Not all cryptocurrencies are mineable, and different coins require different types of hardware.

Before selecting a cryptocurrency to mine, consider factors such as mining difficulty, block rewards, market value, and hardware requirements.

Popular Mineable Cryptocurrencies

Bitcoin (BTC)

- Requires ASIC miners due to high mining difficulty.

- Highly competitive, requiring substantial investment.

- High energy consumption but potentially high returns.

Ethereum Classic (ETC)

- Can be mined using GPUs.

- Based on Ethereum’s original PoW model.

- Lower mining difficulty compared to Bitcoin.

Monero (XMR)

- Supports CPU and GPU mining.

- Focuses on privacy and anonymity.

- Resistant to ASIC mining, ensuring decentralization.

Ravencoin (RVN)

- Optimized for GPU mining.

- Uses the KAWPOW algorithm to prevent ASIC dominance.

Zcash (ZEC)

- Can be mined with both GPUs and ASIC miners.

- Features privacy-focused transactions.

Setting Up Your Mining Hardware

Types of Mining Hardware

The type of mining hardware you choose depends on the cryptocurrency you intend to mine.

1. ASIC Miners

- Designed specifically for mining.

- High hash rates and efficiency.

- Suitable for Bitcoin and some other high-difficulty coins.

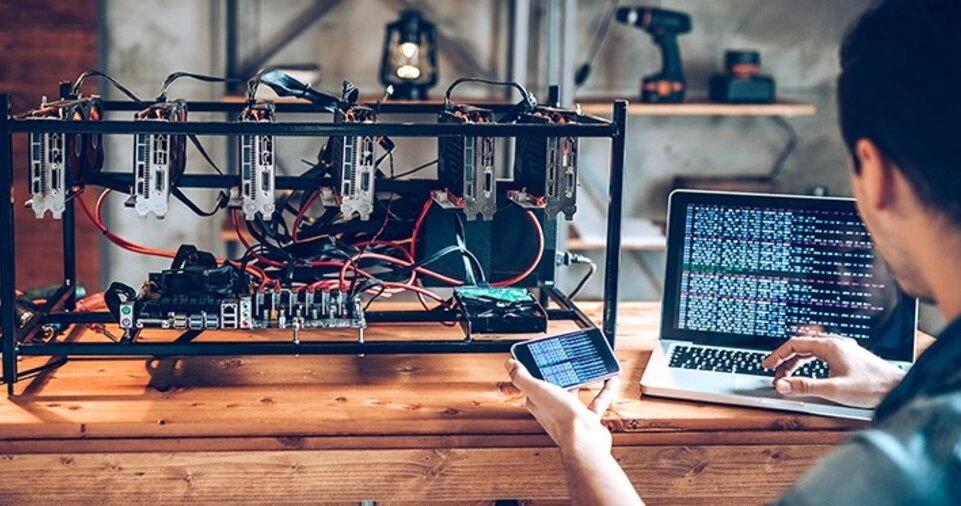

2. GPU Mining Rigs

- Uses graphics cards for mining.

- Suitable for Ethereum Classic, Ravencoin, and other GPU-friendly coins.

- More affordable than ASIC miners.

3. CPU Mining

- Uses the processor to mine cryptocurrency.

- Best for Monero and privacy-focused coins.

- Low investment but lower profitability.

How to Choose the Best Mining Hardware

When selecting mining hardware, consider the following:

- Hash Rate: The speed at which mining hardware solves cryptographic puzzles.

- Power Consumption: Higher energy usage can reduce profitability.

- Initial Cost: ASIC miners are expensive but efficient, while GPUs offer flexibility.

Installing Mining Software

Once your hardware is set up, the next step is installing the right mining software.

Different software supports different cryptocurrencies and mining algorithms.

Best Mining Software

CGMiner

- Open-source and highly customizable.

- Supports Bitcoin and ASIC mining.

NiceHash

- User-friendly software for mining various cryptocurrencies.

- Automatically selects the most profitable coin to mine.

NBMiner

- Designed for GPU mining.

- Supports multiple algorithms, making it versatile.

XMRig

- Best for Monero CPU mining.

- Efficient and optimized for performance.

T-Rex Miner

- Optimized for NVIDIA GPUs.

- Supports multiple altcoins.

Joining a Mining Pool

What is a Mining Pool?

A mining pool is a group of miners who combine their computational power to increase their chances of earning rewards.

The rewards are distributed among pool members based on their contributed hash power.

Best Mining Pools

Slush Pool

- One of the oldest mining pools.

- Great for Bitcoin mining.

F2Pool

- Supports multiple cryptocurrencies.

- High payout reliability.

Ethermine

- Best for Ethereum Classic mining.

- Low fees and high efficiency.

Nanopool

- Supports various altcoins.

- Good for beginner miners.

Setting Up a Cryptocurrency Wallet

To receive and store your mined cryptocurrency, you need a secure wallet.

Wallet options include:

Types of Crypto Wallets

1. Hardware Wallets

- Physical devices like Ledger and Trezor.

- Best for long-term storage and security.

2. Software Wallets

- Digital wallets like Trust Wallet and Exodus.

- Convenient for everyday transactions.

3. Exchange Wallets

- Built-in wallets on exchanges like Binance and Coinbase.

- Easy to use but less secure than hardware wallets.

Configuring and Optimizing Your Mining Setup

After setting up your wallet and mining software, follow these steps:

- Download and install your mining software.

- Enter your wallet address in the mining software.

- Join a mining pool by adding the pool’s server details.

- Adjust power settings to optimize performance and efficiency.

Optimization Tips

- Overclock GPUs to increase hash rates.

- Adjust power limits to reduce electricity costs.

- Monitor temperature to prevent overheating.

Monitoring Mining Performance

Once mining starts, monitor key performance indicators:

- Hash Rate: The speed at which your hardware mines cryptocurrency.

- Temperature: Keep GPUs below 70°C to prevent overheating.

- Electricity Usage: Calculate profitability after power costs.

Withdrawing and Managing Mined Cryptocurrency

Once you accumulate enough cryptocurrency, withdraw it securely:

- Hold for future gains.

- Trade on exchanges for profit.

- Convert to fiat currency if needed.

ALSO READ:

Conclusion

Cryptocurrency mining can be a profitable venture if done correctly. Consider factors like electricity costs, hardware investment, and market conditions before starting.

Mining can provide passive income or be a gateway into the blockchain space.

With the right strategies and continuous learning, you can maximize your earnings and build a successful mining operation.