In the world of finance, cryptocurrency has emerged as a game-changing innovation.

Bitcoin, the first and most widely recognized digital currency, has become a household name.

Its decentralized nature, finite supply, and potential for high returns make it an attractive investment option.

However, diving into the world of cryptocurrency can seem overwhelming, especially for first-time investors.

Whether you’re curious about Bitcoin’s potential or ready to make your first purchase, understanding the process is crucial.

From selecting a reliable exchange to securing your digital assets, each step plays a role in ensuring a safe and informed investment journey.

In this guide, we’ll walk you through everything you need to know about buying and managing Bitcoin or other cryptocurrencies, empowering you to confidently join the digital asset revolution.

What You Need to Know Before Investing

Investing in Bitcoin or altcoins requires careful consideration of your financial goals and risk tolerance.

Bitcoin’s value is driven by market speculation, its limited supply, and its utility as a payment method and store of value.

Key Takeaways

- Bitcoin can be purchased in fractional amounts, making it accessible for any budget.

- Privacy and security are critical when managing cryptocurrency.

- Bitcoin transactions are transparent but only pseudo-anonymous, as user identities can be linked to public keys on exchanges.

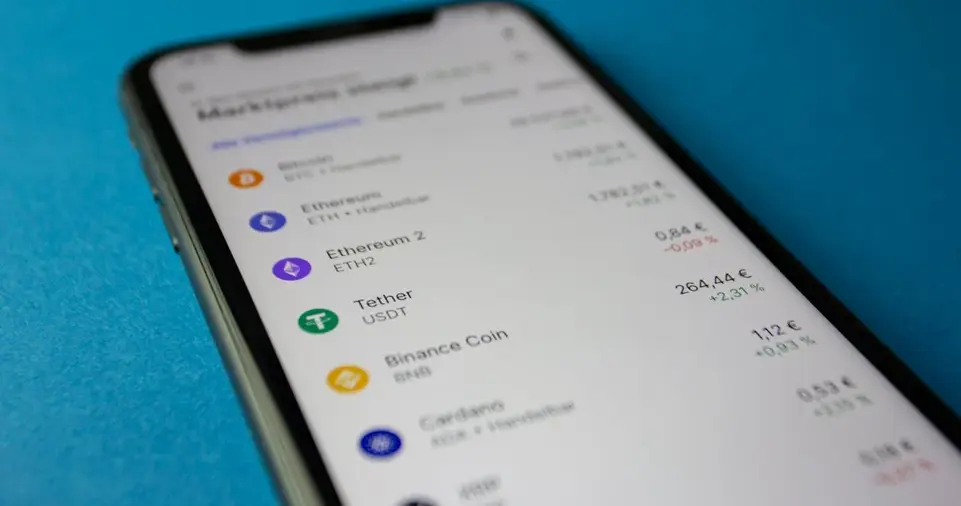

Step 1: Choose a Reliable Platform

There are two primary types of platforms to buy cryptocurrency:

- Centralized Exchanges: Platforms like Coinbase, Kraken, and Binance require Know Your Customer (KYC) verification and provide regulated, user-friendly services.

- Decentralized Exchanges: These platforms offer greater anonymity but may lack beginner-friendly features.

When selecting a platform, consider security features, transaction fees, and the variety of cryptocurrencies available.

Step 2: Set Up Your Account and Secure Your Wallet

Creating an account on a centralized exchange often involves:

- Submitting identification documents for KYC compliance.

- Using a secure password and enabling two-factor authentication (2FA).

Hot Wallets vs. Cold Wallets

- Hot Wallets: Convenient and connected to the internet but vulnerable to cyber threats. Ideal for small or frequent transactions.

- Cold Wallets: Offline storage options like hardware wallets or paper wallets offer maximum security. Best for long-term or significant holdings.

Step 3: Connect a Payment Method

Depending on the exchange, you can fund your account using:

- Bank transfers

- Debit or credit cards

- PayPal or other digital payment services

- Peer-to-peer (P2P) platforms

Be aware that fees vary by method, and using a credit card may incur additional costs due to interest and volatility.

Step 4: Purchase Bitcoin or Altcoins

Once your account is set up and funded, place an order:

- Market Orders: Execute trades instantly at the current price.

- Limit Orders: Set a specific price at which you want to buy.

Many exchanges also allow recurring purchases, enabling you to dollar-cost average your investments.

Step 5: Transfer Your Holdings to a Secure Wallet

Leaving your cryptocurrency on an exchange can expose it to hacking risks. Transfer your coins to a personal wallet to ensure control over your private keys.

Alternative Ways to Buy Bitcoin

- Bitcoin ATMs: Purchase Bitcoin with cash. These machines often charge high fees but are convenient.

- PayPal: Buy Bitcoin directly through your PayPal balance or linked accounts.

- P2P Exchanges: Platforms like LocalBitcoins connect buyers and sellers directly, allowing for negotiation on payment methods and prices.

Safe Storage Practices

- Use strong passwords and 2FA.

- Keep your private keys offline.

- Diversify holdings across multiple wallets to minimize risks.

Bitcoin’s Legal and Regulatory Considerations

Before investing, understand your country’s regulatory stance on cryptocurrency.

Many jurisdictions require compliance with KYC laws to prevent illegal activities such as money laundering.

How to Sell Bitcoin or Altcoins

Selling cryptocurrency is as straightforward as buying it. Most exchanges allow users to sell their digital assets for fiat currency or trade them for other cryptocurrencies.

Steps to Sell Your Cryptocurrency

- Log Into Your Exchange Account: Ensure you use a platform where you hold your cryptocurrency or transfer the assets back from your wallet.

- Select the Cryptocurrency to Sell: Choose the coin and amount you wish to sell.

- Place a Sell Order:

- Market Order: Sell at the current market price.

- Limit Order: Set a price at which to sell, and the exchange will execute the order when the market reaches that price.

After selling, you can withdraw your funds to a bank account or other linked payment methods. Be aware of transaction fees and withdrawal limits, which vary by platform.

Consider Tax Implications

Cryptocurrency transactions, including sales, are taxable in many jurisdictions. Ensure you report your gains or losses according to local tax laws. Tools like crypto tax software can help simplify the process.

Tips for First-Time Cryptocurrency Investors

- Start Small: Invest an amount you can afford to lose, especially if you’re new to cryptocurrency.

- Do Your Research: Study the market, understand the technology, and keep track of trends.

- Stay Updated: Follow reliable sources to remain informed about changes in regulations, market dynamics, and technological advancements.

- Avoid Emotional Decisions: Cryptocurrency markets are volatile. Base your investments on research, not market hype or fear.

The Future of Bitcoin and Cryptocurrency

Cryptocurrency is evolving rapidly, with increasing mainstream adoption and new use cases emerging.

Payment platforms like PayPal and investment firms like Fidelity now offer Bitcoin-related services, signaling growing acceptance.

While the potential for high returns is enticing, it’s essential to approach cryptocurrency with a well-thought-out strategy and a focus on security.

By staying informed and practicing safe trading habits, you can confidently explore this transformative asset class.

Advanced Strategies for Investing in Cryptocurrency

Once you’ve mastered the basics, you may consider exploring advanced strategies to maximize your returns and diversify your portfolio.

Diversify Your Crypto Portfolio

Investing in multiple cryptocurrencies can reduce risk and increase exposure to emerging projects.

Beyond Bitcoin, explore altcoins such as Ethereum (ETH), Cardano (ADA), or Solana (SOL), which offer unique utilities and ecosystems.

Use Dollar-Cost Averaging (DCA)

DCA is a popular investment strategy that involves investing a fixed amount of money at regular intervals, regardless of market fluctuations.

This approach minimizes the impact of volatility and helps reduce emotional decision-making.

Staking and Yield Farming

Certain cryptocurrencies allow you to stake your holdings to earn passive income or participate in yield farming on decentralized finance (DeFi) platforms.

While these methods can be lucrative, they carry risks, such as smart contract vulnerabilities or token devaluation.

Leverage Market Trends with Technical Analysis

Technical analysis involves studying price charts and indicators to predict future market movements.

By understanding trends, support, and resistance levels, you can make more informed trading decisions.

Explore Initial Coin Offerings (ICOs) and New Tokens

Participating in ICOs or investing in newly launched tokens can offer high potential rewards.

However, due diligence is essential, as these investments carry high risk and are prone to scams.

Common Mistakes to Avoid When Investing in Cryptocurrency

- Chasing Hype: Avoid buying into projects solely based on media attention or social media trends without understanding their fundamentals.

- Ignoring Security Best Practices: Always use secure wallets and strong authentication methods to protect your assets.

- Investing More Than You Can Afford to Lose: Cryptocurrency markets are volatile, and losses can occur. Invest within your financial capacity.

- Falling for Scams: Beware of too-good-to-be-true investment schemes, fake wallet apps, or phishing attempts targeting crypto users.

Resources for Learning More About Cryptocurrency

- Educational Websites: Platforms like Investopedia, CoinDesk, and CoinMarketCap offer comprehensive guides on cryptocurrency.

- Online Communities: Join forums and groups like Reddit’s r/cryptocurrency or Telegram communities to engage with other investors.

- Books: Consider reading books like The Bitcoin Standard by Saifedean Ammous or Digital Gold by Nathaniel Popper.

- Courses: Online platforms like Coursera and Udemy offer beginner to advanced courses on blockchain and cryptocurrency.

ALSO READ: How to Set Up a Crypto Wallet: A Step-by-Step Guide

The Bottom Line

Cryptocurrency represents a revolutionary shift in the financial world, offering opportunities for innovation, investment, and financial independence.

Whether you’re buying Bitcoin for the first time or diving into advanced trading strategies, success in this space requires knowledge, patience, and discipline.

By understanding the steps involved in buying and securing cryptocurrency, exploring advanced techniques, and staying vigilant about risks, you can confidently participate in the growing world of digital assets.

Ready to start your crypto journey? Take the first step today by choosing a reliable exchange and securing your wallet—your future in the digital economy awaits!